Innovative Credit Analytics

Software for assessing the creditworthiness of your counterparties and target companies

The software allows you to form a credit assessment of the company based on open source data. Examples of data used for analysis: balance sheet, income statements, amount of taxes paid, current and historical court proceedings, portfolio of government contracts

The collected data is transmitted via the API for further analysis and checked for missing values, the data is restored using a preliminary prepared MIE Imputer algorithm. The generated data array, taking into account preprocessing, is evaluated using ensemble of gradient boosting models (catboost and lightgbm). The algorithm not only knows how to distinguish between good and bad companies, but is also able to calculate the recommended amount of credit amount, expected probability of default, analyze for potential colaterals and pledges and structure the whole deal

Pricing: Basic package ($10,000), Advanced Package ($50,000), Premium Package ($90,000)

In order to see the description of different packages, please follow our pricing tab

- Boosting your credit analytics

- Identification of unreliable counterparties

- Determination of credit quality and solvency

- Usage of advanced machine learning models

We Support Our Clients Five Working Days

The solution provides constant flow of credit deceision requiring the only unique identification marker per company. The solution is provided as a cloud-based platform allowing to log the history of requests and retrieve data and markers online

- 30-second cycle per company for final decision

- Maximum precision of decisions

- Technical Support Service

- Adaption of algorithm per client needs

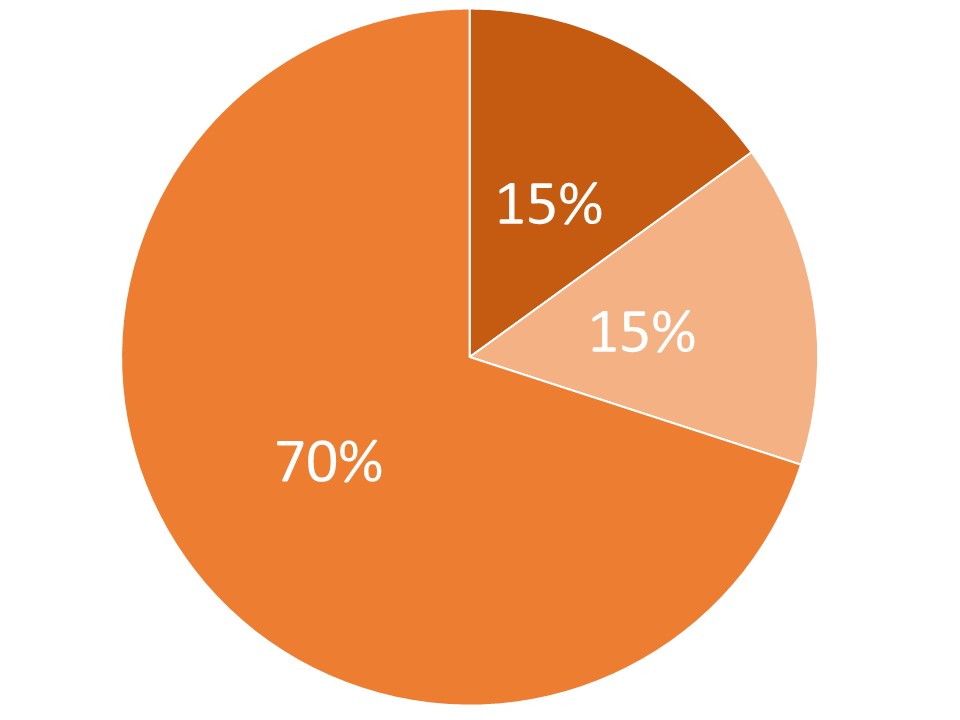

Our product represents a unique synergy of the team's experience and technological models in the field of credit analytics. The product was developed in parallel with the credit scoring process by our analysts, providing the most comparable results on relevant data of borrowers. Using a product allows to focus on sales rather than scoring and solves internal compliance problems as a company gets an independent scoring mechanism working 24/7. The first solution on the market allowing to fetch data from credit bureaus, financial statements and internal accounting statements of the company for all-round assessment

The product is effective in terms of saving your company's resources, both human and financial. The software generates a credit score within 60 seconds if all software requirements are met. In addition, there is the possibility of evaluating not only a standalone company, but also the entire Group based on the consolidated financial statements. The solution not only generates a scroing level, but provides explicit AI-powered analysis of strong and weak parts of the company thus justifying the decision and replicating the logic of a human-led credit committee

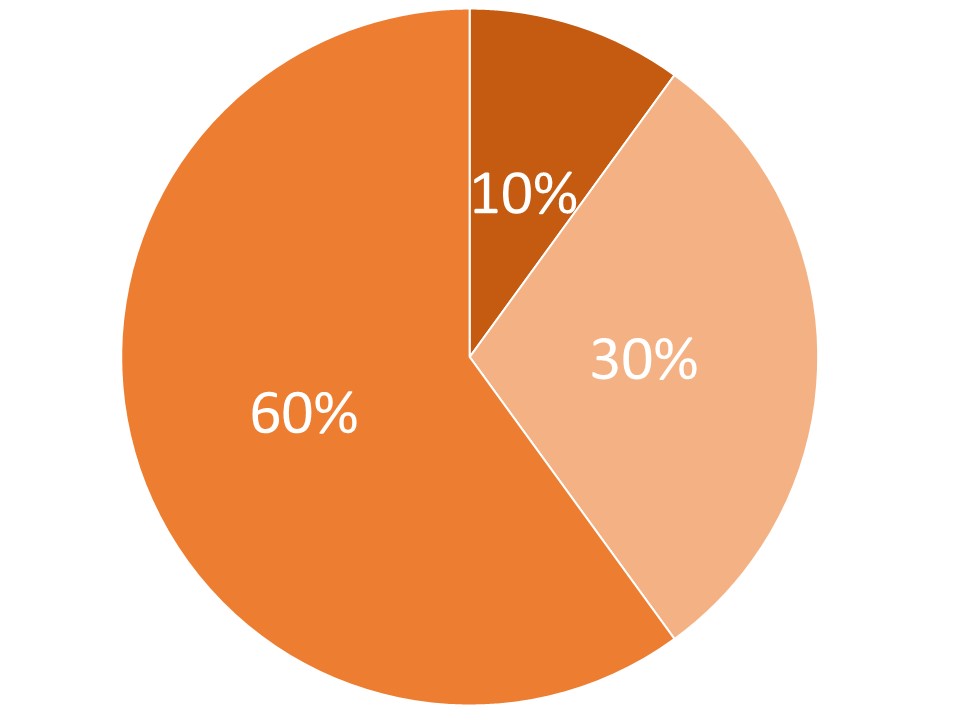

In terms of price and quality, the product is one of the most profitable options, allowing you to plan your budget in advance and choose a tariff plan that suits your needs. In addition to the product, our employees of the customer service department will always be happy to prompt and guide you on any questions that arise. The solution allows to make an unlimited number of assessments making a per case cost of credit analysis extremely low in comparison to human-made scoring